At its finest, IBP is fully aligned with growth and innovation metrics, having turned S&OP into a strategic business partner. Visualize aligning your company’s operational decisions with forward-looking financial performance across various timeframes, representing complex trade-offs, constraints, and real-time business realities across the value chain; this is what a successful IBP looks like!

For more than a decade, our customers have struggled with the term IBP and how it relates to sales and operations planning (S&OP), sales and operations execution (SOE) sales inventory operations planning (SIOP), sales and operations management (S&OM), and other processes.

Despite knowing its importance, businesses have been slow to adopt integrated business planning. Many have yet to establish a fluid S&OP process.

Why Companies Struggle to Adopt IBP

So…why are companies still struggling to adopt IBP? A few reasons include:

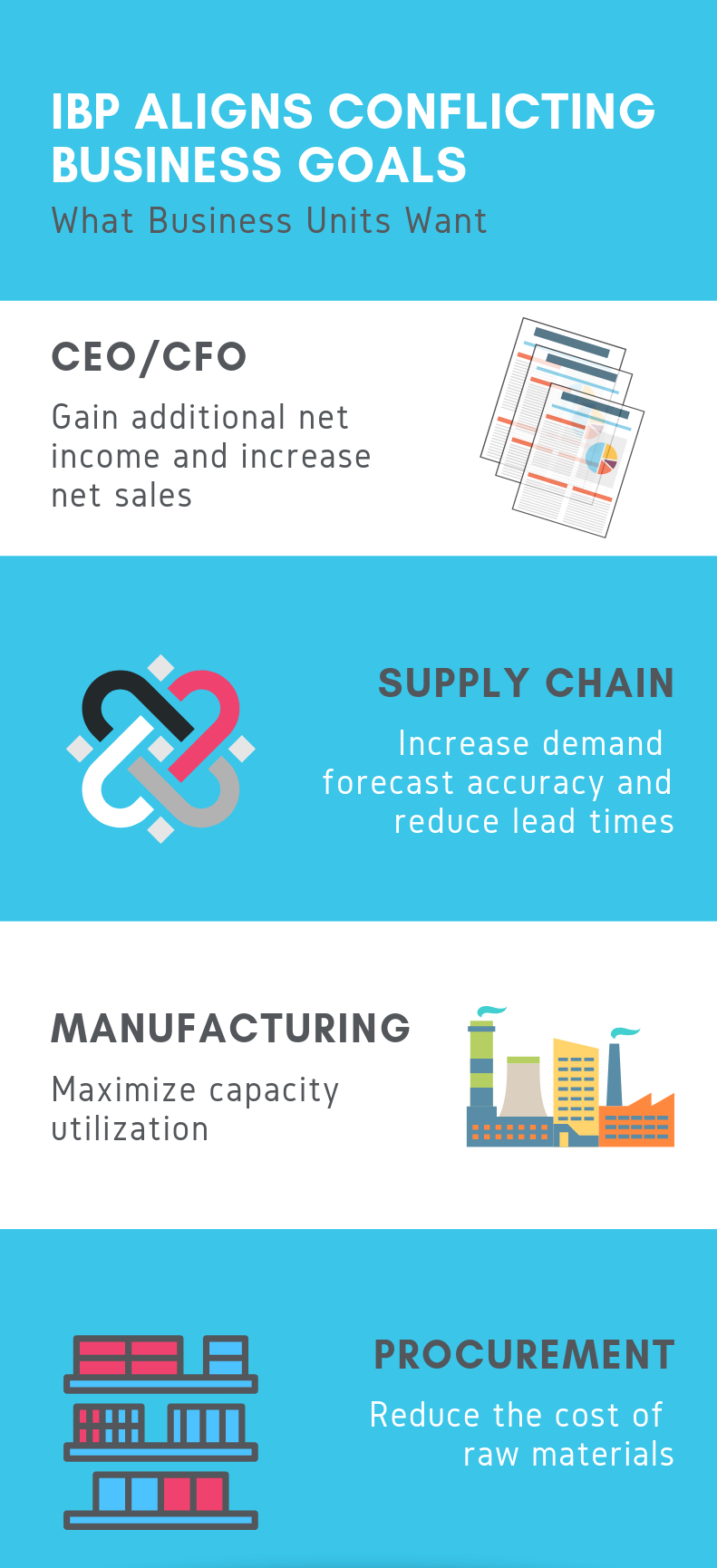

- Conflicting goals among business units and barriers due to the evolutions of processes and technologies

- Existing technology design

- Traditional methods of doing business

A recent study shows that 79% of companies continue to use spreadsheet planning, yet only 39% say that spreadsheets support a collaborative planning process.

Here’s the problem: Inflexible tools like spreadsheets don’t allow for a cross-functional representation of the business. Also, spreadsheets don’t provide forward-looking insights — a requirement for IBP. Instead, spreadsheets produce infeasible plans, inhibit collaborative planning, and suck loads of time that could be better spent elsewhere.

In one case study, a snack food giant wasn’t meeting demand on its most profitable product due to constrained capacities. When it tried utilizing its 20+ spreadsheets, they continued to fall short of reaching targets and became well aware that they were missing out on major profit opportunities.

Spreadsheets may work for isolated scenarios but not integrating functions to solve one common goal (meeting demand) while aligning with strategic objectives (e.g., recognizing additional profit opportunities). This is the essence of integrated business planning

Top 7 Barriers to Integrated Business Planning

In addition to spreadsheets, here are a few other barriers that we have found:

- Technology and process structures don’t allow integration. Traditional software solution designs differ in structure, hindering integration. Supply chain software was built from the ground up with a data model that was singularly focused toward certain areas like demand, supply, logistics, etc. Financial planning and analysis tools which model the General Ledger/Chart of Accounts from a transactional and roll-up perspective take the opposite approach. As such, supply chain planning and financial planning technologies were never destined to meet.

- Complex skill set required. Optimization solutions present barriers within barriers: modeling a complex supply chain often requires difficult coding and provides no visualization.

- Different cultures within the organization. Business units within the enterprise usually have a culture of its own; the undertaking of understanding another unit’s goals while striving to reach its own seemed impossible.

- Linear scenario management tools. Like optimization, scenario management tools can’t replicate real-world complexities, nor acknowledge that what-ifs are not linear.

- Use of spreadsheets as a primary planning tool. Maintaining the status quo use of spreadsheets presents an inflexible resource unable to integrate and align business goals.

- Inflexible solutions prevent data quality, access, and management. Solutions are designed to operate a specific way, and often unlike the business, meaning that the access to data or its quality and management are reliant upon the system.

- No C-Suite awareness. Understanding the meaning and feasibility of IBP often lies outside the C-Suite periphery. As a relatively new process that has been difficult to put into practice, IBP is an educational endeavor within the organization; IBP fails to get the attention of the C-Suite that benefits from it most. The CEO/CFO can be unaware of the benefits of IBP. In this post, we describe situations where employees keep profit-improving opportunities a secret, because an individual silo may be somewhat negatively impacted.

Clearly, navigating the challenges to implementing IBP starts with understanding the advantages that IBP provides.

How Does IBP Work?

IBP represents the end-to-end business goals with a process that takes into consideration each business silo and its various functions. For example, is the operational plan represented in a cash flow statement? If not, what good is an operating plan that includes a product mix with margin contributions that put cash flow risk? It’s why the outcome of IBP is a true business plan, rather than a demand plan, supply plan, production plan, or a financial budget.

Through IBP, enterprises gain a single holistic plan that unifies the business, seamlessly connecting corporate performance management, financial planning processes, and operational planning systems. This comprehensive business plan increases business alignment through the sharing of performance strategies and helps quantify business risk so enterprises can rapidly adapt to meet challenges.

Why We Need IBP Now More than Ever

Even in a good economy, financial pressure to perform is paramount to maintaining a competitive edge and interesting enough, no different than the factors driving IBP following the 2009 recession. These include:

- Demand volatility has increased considerably for most companies.

- Supply complexity has increased with options such as subcontracting manufacturing and logistics operations — both of which are more common. Supply chains are broader in scope, including goods that are distributed across worldwide supply chains.

- Input cost volatility is a constant, increasing challenge for profitability. No matter the commodity (e.g., aluminum, gas, or petrochemicals), all experience sudden market changes.

- Non-linear connection between costs and volume fluctuates with a mix of fixed and variable costs; some costs vary by volume and others by time, making it more difficult to understand the financial implications of business decisions.

Yet, IBP is essentially an outgrowth of S&OP that fully aligns customer, product, demand, product, and strategic portfolios across a value chain to drive the strategy of a company, its financial performance, and its operational and tactical plans. This realization began as early as decades ago but hasn’t gained much traction in implementation until recently.

With process changes like global sourcing and distribution, the complexities of the supply chain make it necessary to synchronize operational plans with financial and strategic business goals and understand impacts to the enterprise as a whole.

The Need for What-If Analysis for Successful Integrated Business Planning

IBP is only possible with cross-enterprise, what-if scenario planning across various planning horizons. With true integrated business planning, new questions to new answers can be address — driving unmatched value to every aspect of the value chain.

In one use case involving a product mix portfolio, IBP can answer what-ifs such as:

- What if we need to move from one raw material to another, over the next several years?

- What if we want to expand into new opportunities. Where should we be investing?

- What if we make changes in design, materials, and production. How will it affect short- and long-term planning?

- What if new capital expenditures are required today and in the future?

- What if we made acquisitions instead of more capital expenditure projects?

The what-ifs allow companies to find optimal scenarios in addition to optimizing the existing way of doing business.

In other words, what-if scenario analysis is what allows companies to integrate their supply chain plans with finance, manufacturing, procurement, sales, marketing, etc.

The Unmatched Benefits of IBP

IBP has some astounding impacts on those companies who successfully adopt it. Some of the benefits our customers have seen are:

- Profit improvements equal to 2-5% of annual revenue within the first year alone

- Reduced working capital expenses by 15% or more

- Optimization of logistics, capacity, procurement, supply and demand all with the use of a single planning solution

- Improved cross-functional collaboration, planning agility, risk mitigation, and forecast accuracy

- Reduced planning timeframes from weeks or months to just a few days or hours.

- Increased stakeholder value for the company, at large

- Broader trust in plans

6 Factors to Find the Best IBP Solution

Cloud-based technologies, machine learning, and artificial intelligence (AI) sources have eliminated some technology barriers; however, traditional methods continue to play a significant role in preventing companies from using IBP.

When evaluating Integrated Business Planning solutions, these should include:

- Can execution characteristics, capabilities, and constraints be modeled correctly in order to gain an achievable strategic plan?

- Can the IBP solution co-create financial plans in sync with operational plans? Note: a financial plan refers to audit quality financial statements (e.g., Income statement, Balance Sheet, Cash Flow) which provide a full financial picture?

- Does this solution allow users to clearly understand variances – from a budget to a plan, or a baseline to a scenario, at operational and financial levels?)

- Can the solution evaluate alternative “what-if” scenarios in the formation of budgets, strategies, and operational plans? Can the scenarios consider financials as constraints? Can the scenarios optimize to multiple objective functions at the discretion of the user?

- Can we drill down and understand the root causes of those gaps?

- Does the solution have a concept of marginal contribution? This provides the specifics needed to understand the targeted actions taken. If more of this product is sold, will it have this impact? Is it worth it? If less of that product is sold, will it have this impact? Are the risks worth taking?

Intelligent Modeling as a Requirement for Successful IBP

Successful Integrated Business Planning includes unique technology capabilities. Below are the most important ones:

- An underlying holistic model that represents the business as it behaves in reality, including business, financial, and supply chain constraints. Additionally, it is essential to know how variable and fixed costs are incurred, the structure of reporting hierarchies, and process flows with mass/energy balance.

- The integrated model should support advanced analytics to enable users to identify and evaluate the best plans and decisions, including:

- Allowing users to simulate and optimize scenarios with multiple objective functions

- Supporting analyses from different angles (e.g., solving for optimal product mix rather than holding product mix constant, and solving for a supply plan) allow users to communicate effectively and understand the impact on key performance indicators.

- Providing rich information, including detailed cost analyses, marginal profitability, financial statements, key bottlenecks/constraints, etc.

River Logic as a Recognized Leader in S&OP/IBP

Currently, River Logic is a Leader in Gartner’s Magic Quadrant for S&OP and a Gartner-ranked global leader in both prescriptive analytics/optimization and Corporate Financial Planning. To date, we are the only vendor that is noted in all three of these areas.

River Logic has been a long-time thought leader in the IBP space and has been delivering Integrated Business Planning and S&OP solutions to global clients since 2005.

Our solution fundamentally looks at IBP through the lens of the CEO/CFO: charts of financial accounts and net income and a focus on the value chain. In other words, it truly has an integrated business plan as part of its data model regarding finance, supply, demand and any value chain function that needs to be modeled. River Logic is a comprehensive business modeling tool and much more than just supply-chain modeling tool.

1Magic Quadrant for Sales and Operations Planning Systems of Differentiation, Gartner Research, May 2017.