Just when shale production marked a significant rebound, an event occurs with the potential to put a dent in the boom. That event is this month’s behemoth Starbucks announcement. It pledges by 2020 to phase out more than a billion-plus single, plastic straws that it distributes annually in its 27,000-plus stores in 75 countries. The announcement follows the city of Seattle’s ban, effective July 1st, 2018, on plastic utensils, straws, and cocktail picks for food service businesses.

Meanwhile, oil and gas, the primary raw ingredient in manufacturing plastic, has dedicated $185 billion in petrochemicals investments. According to the American Chemistry Council, these are currently in the construction and planning stages.

Exactly how Starbucks’ recent news could impact the plastics industry, which has picked up newfound popularity with lower-priced resources and product demand caused by the growing, global middle-class, remains to be seen. Can a billion straws make a difference? Perhaps, considering companies like Coca-Cola, Dunkin’ Donuts, and McDonald’s have been quick to follow suit with similar pledges.

Americans alone use half a billion straws daily, and much of this plastic waste ends up in the ocean. By the year 2050, one report predicts that there will be more plastic in the ocean than fish.

Since World War II, plastics use has been widespread for its versatility and low cost. From medical devices to consumer-packaged goods, about 250 to 300 million tons of plastic are produced each year globally.

The seven classifications of plastics for use and recycling are coded with a number inside a triangle code on most products. Safe plastics, like Number 2 for HDPE (high-density polyethylene), are used for packaging, like yogurt containers, and not known to transmit chemicals into food. Number 2 plastics can be recycled to make detergent bottles, pens, floor tiles, and fencing. In contrast, a Number 7 plastic contains Bisphenol-A, known as BPA, an organic synthetic compound linked to heart disease and obesity.

Straws use Number 5 (polypropylene) plastic, known to be safe with no known transmission of leaking chemicals into food. One straw takes up to 200 years to decompose, but that’s less than half the time of a plastic water bottle that will survive 450 years.

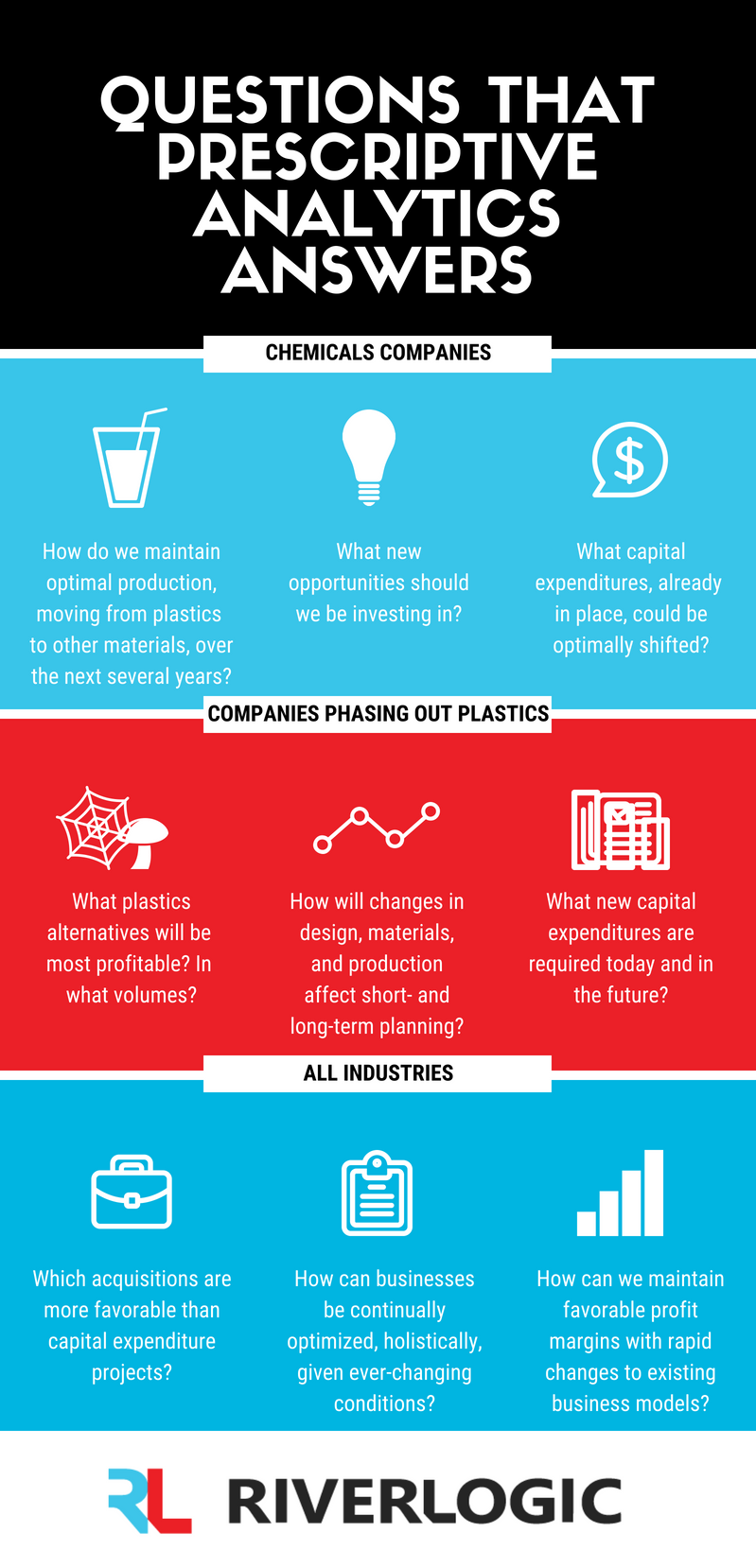

Corporations responding to consumers’ environmental concerns and increasing social responsibility have begun to put plans into place that minimize and rid plastics use in their products. This shift away from many types of plastics raises several questions for multiple industries:

Prescriptive Analytics: Critical for Fast-Changing Events and Maintaining Profitability

No industry is immune to the events like the ones concerning plastics, necessitating relatively fast changes in response to consumer preferences that impact traditional business models. It’s these kinds of changes that present critical issues for companies that want to pivot to market needs while managing inventory phase-out, testing new product designs and acceptance, and maintaining profitability.

While Starbucks is only a tenth in revenue size as compared to Exxon Mobil and a minuscule fraction to the entire oil and gas industry, its precedent sounds the alarm. Analogous to the hypothetical hundredth monkey effect, behavior on a global scale can change in as little as a few years. Scientifically-rooted is the Rensselaer Polytechnic Institute research finding that when just 10 percent of the population holds an unshakable belief, their belief will always be adopted by most of society. It’s these consumer beliefs and habit changes that may conflict with multi-billion-dollar plans underway to increase plastics production.

For now, however, the demand for plastics is forecasted to rise for the next several decades, making the U.S. the major plastics exporter.

Evaluating the Alternatives and Forecasting for Accuracy

One industry’s loss is another’s gain. When it comes to straws, paper products manufacturers could see an uptick in business. In the U.K., McDonald’s has plans to test paper straws in some locations. The test also keeps all straws behind the counter, only available upon customer request.

Biofabrication provides other alternatives to plastics. From spider silk to fungi, these lab-grown materials are on the cusp of being available in mass quantities with feasible prices. Unlike harvesting natural resources, living organisms are created with other product wastes to make plastic-like material from shrimp shells, for example, and polymer-strength substances from the roots of fungi.

Biofabrication is unique in that substances can be programmed to be specific colors or react to other environmental elements. Hypothetically, a smart straw made from mushrooms could change colors depending temperature of the drink; think bright blue for icy cold temps and scarlet red for scorching hot.

With future possibilities and today’s realities, there’s only one technology – prescriptive analytics – that can take strategic investment decisions, medium- and long-term planning, and integrate with the company’s current portfolio. Prescriptive analytics can also assess the impacts of product mix changes and make fast recommendations on alternative paths. With the right form of prescriptive analytics, hundreds or thousands of scenarios can be mapped in no time, all within whatever constraints and objectives defined and showing the exact financial impact of each.

As noted in The New Oil and Gas Quarterback to Climate Change Solutions: Prescriptive Analytics, prescriptive analytics provides the best path forward given the realities and allowing for optimized business objectives, while accurately prescribing where profitability lies. This incorporates the possibilities of shifting from a thermoplastic polymer straw to a color-changing, fungi-based one.